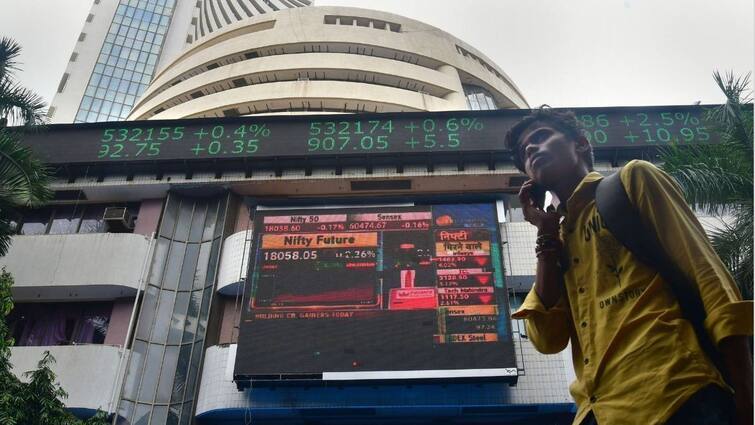

Investors lose ₹60 trillion in little over 100 days; pain to continue

Live MintMUMBAI : The recent equities sell-off, led by aggressive offloading by foreign portfolio investors, has eroded investor wealth worth nearly ₹60 trillion in the past three and a half months. The sell-off has been led by FPIs who have offloaded cash market or secondary shares worth a net ₹1.85 trillion since October through 12 January amid a falling rupee and rising crude oil prices due to fresh US curbs on Russia, showed data from National Securities Depository Ltd and BSE Ltd. Meanwhile, domestic institutional investors, led by mutual funds, have net purchased shares worth ₹2.18 trillion from the secondary market over the same period, showed BSE data. However, FPI buying looks unlikely to happen soon with the rupee weakening and crude rising because of rising bond yields in the US ahead of President-elect Donald Trump's inauguration and the latest round of sanctions imposed by the outgoing Joe Biden administration on Russian tankers and maritime insurers.

History of this topic

India’s $556 Billion Equity Rout Seen Worsening as Growth Cools

Live Mint

FPIs on selling spree: ₹22,000 crore withdrawn from Indian equities in January

Live Mint

FPIs resume selling spree in January, pull out nearly ₹12,000 crore from Indian equities. What’s in store ahead?

Live Mint

Indian shares edge lower on worries over likely moderation in earnings

Live Mint

Nifty at 26,000? Citigroup sees 10% upside for Indian stocks in 2025; here’s why

Live Mint

FPIs to remain cautious on India until clarity comes on Q3 FY25 earnings: Report

Live Mint

Intraday stocks for today under ₹100: Experts recommend five shares to buy or sell today — 7 January 2025

Live Mint

Stock market recovers after yesterday's crash. What's next on Dalal Street?

India Today

FPIs withdraw ₹4,285 crore in 3 trading sessions amid high valuations, global headwinds

Live Mint

Improved earnings of Indian corporates set to drive returns in 2025: Report

Live Mint

Rupee dents FPI dollar returns in 2024

Live Mint

FPIs pump ₹1.65 lakh cr in Indian markets, equity inflows plunge 99% to ₹427 cr in 2024: What lies ahead in 2025?

Live Mint

Stock market this week: Top 5 stocks with the biggest gains and losses

Live Mint

Indian shares set to open higher as investors await earnings season

Hindustan Times

Mutual Funds: Total asset size spikes 40% in a year, individuals own lion’s share as equity schemes turn favourites

Live Mint

India’s stock market in 2025 and the growing appeal of US bonds

Live Mint

FPI inflows into Indian equities drop sharply in 2024; rebound anticipated in 2025

Live Mint

Bears rip ₹8.75 trillion of investor wealth

Live MintBears tighten grip on markets; Sensex tanks 1,176 points; Nifty falls below 23,500 level

The HinduMarkets decline in early trade amid unabated foreign fund outflows

The Hindu

Stock Market Today: Sensex Plummet 400 Points, Nifty Below 23,850

ABP News

Investors’ wealth erodes by ₹9.65 lakh cr in four days of market sell-off

Live MintMarkets decline in early trade amid foreign fund outflows; all eyes on U.S. Fed interest rate decision

The Hindu

Sensex, Nifty open lower as cautious investors weigh global trends

India Today

Sensex, Nifty down 1.3% as weak rupee spark FPI selling

Live Mint

Markets slump over 1% amid widespread selloff; Sensex sinks below 81k

The HinduMarkets decline in early trade dragged by Reliance, HDFC Bank; caution ahead of U.S. Fed rate decision

The Hindu

FPIs make a comeback, lap up Indian stocks worth ₹14,435 crore in December after two months of selling

Live MintMarkets decline in early trade amid weak global trends

The Hindu

FPIs pump ₹22,766 crore in Indian equities; Will the inflows continue in December? Experts weigh in

Live Mint

Market sees sharpest swing in 6 months before closing in green

Live Mint

Sensex Nifty recovery: Strong comeback amid easing inflation, buying in telecom stocks

The Hindu

FPIs Reverse Sentiment, Infuse Rs 24,454 Crore In Equities In December So Far

ABP News

FPIs stage a comeback in December, infuse ₹24,454 crore into Indian equities; Is the sell-off over?

Live Mint

FPIs return as buyers in December, purchase equities worth ₹14,000 crore in Indian stock market

Live Mint

Stock market today: Over 250 stocks hit fresh one-year highs on BSE; investors earn nearly ₹4 lakh crore in a day

Live Mint

Share Market Today: Sensex Gains 490 Points; Nifty Above 24,400. Adani Ports Jump 4%

ABP News

FPI selling spree slowed in November; will inflows pick up in the coming months?

Live Mint

FPIs end 3-day buying run with ₹11,756 crore sell-off; Nov outflows hit ₹41,300 crore

Live Mint

Heavy FII selling, derivatives expiry torpedo relief rally

Live Mint

Share Market Today: Sensex Sheds 700 Points; Nifty Below 24,100. IT, Auto Drag

ABP News

FPIs return to Indian stock market after 36-day selling streak; is the trend sustainable?

Live Mint)

Sensex, Nifty jump over 1.3%, providing relief after weeks of foreign investor-led sell-off

Firstpost

₹1.5 lakh crore offloaded since Oct! Will FIIs return to Indian stock market anytime soon? Experts weigh in

Live Mint

Indian rupee hits fresh low amid US dollar rally and ongoing FPI selloff

Live Mint

Investors lose nearly ₹50 trillion in 7 weeks

Live Mint

FPIs offload ₹22,420 crore from Indian equities in November: 5 key factors behind sell-off

Live Mint

Relentless FPI selling triggers ₹27,680 crore outflow from Indian equities in November

Live MintSensex, Nifty trade firm in early trade

The HinduDiscover Related