)

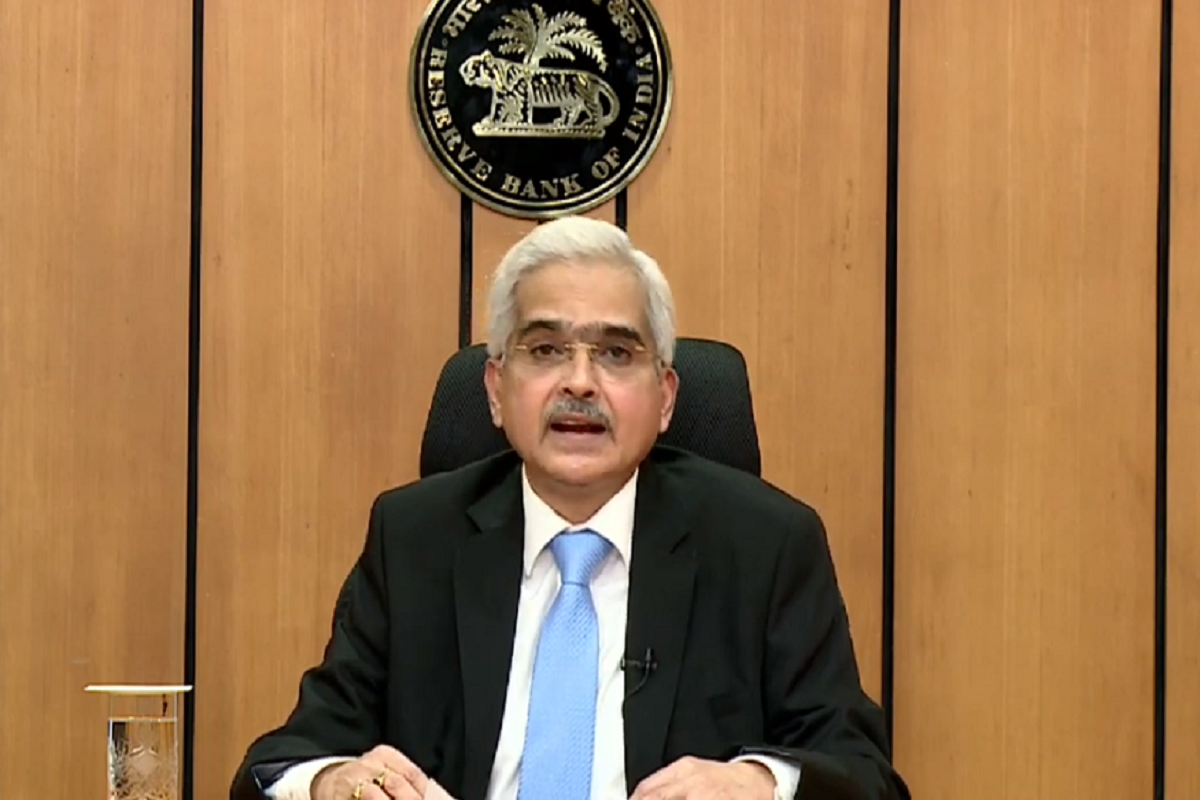

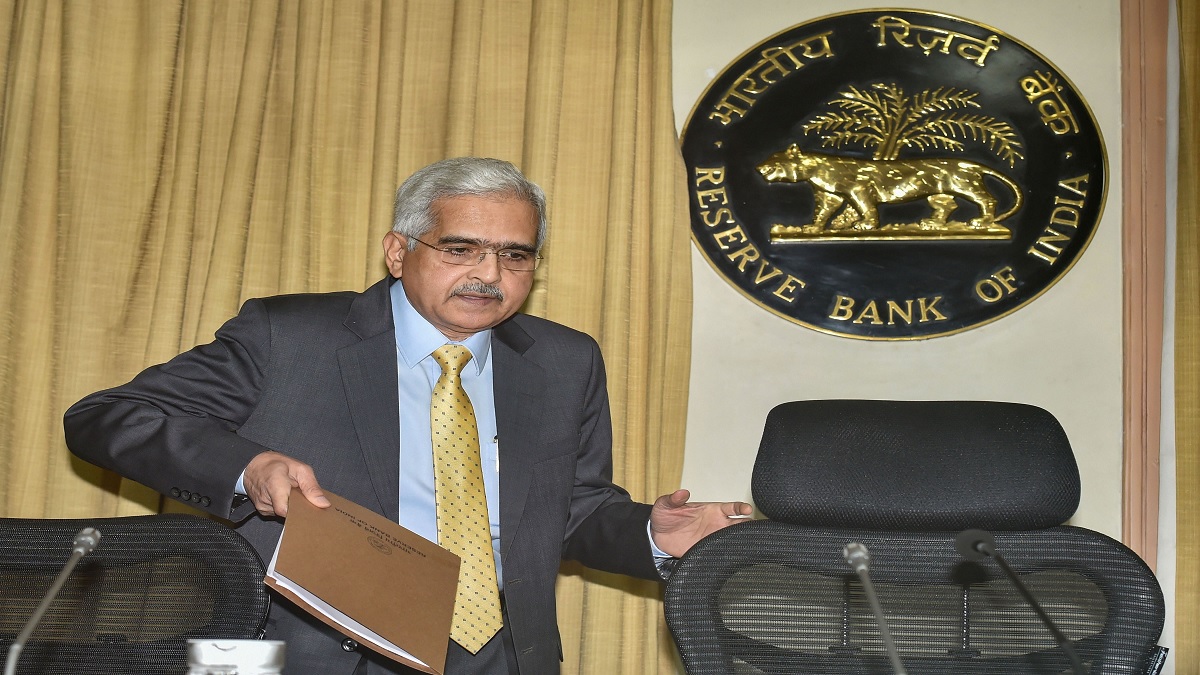

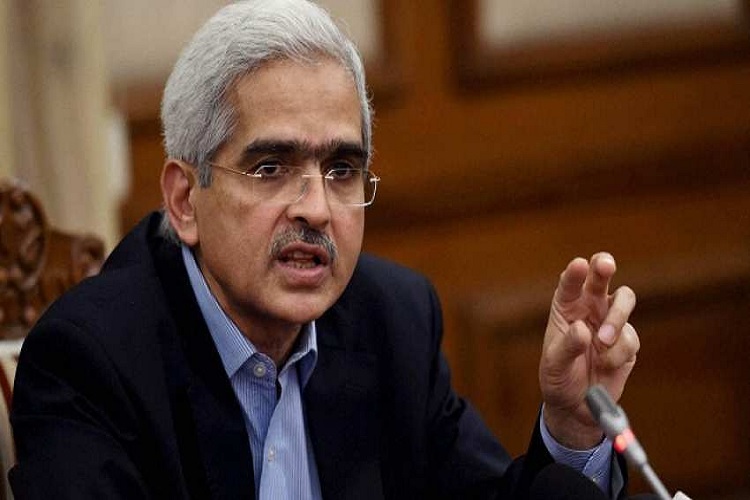

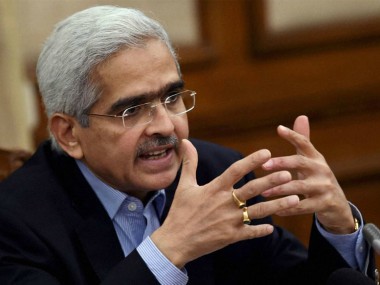

Coronavirus Outbreak: RBI governor Shaktikanta Das meets NBFCs, MFs sector; reviews liquidity situation

FirstpostOperations of NBFCs have commenced from Monday as the government eased restrictions for the lockdown. Mumbai: Reserve Bank governor Shaktikanta Das on Monday reviewed liquidity position and ways to promote lending to the MSME sector during a meeting with representatives of non-banking financial companies and mutual funds amid the lockdown induced by the COVID-19 pandemic. Some of the issues discussed during the meeting included availability of liquidity from banks and other financial institutions and post-lockdown strategies for supply of credit, including working capital, to MSMEs, traders and bottom of pyramid customers in semi-urban, rural and urban areas, the RBI said. Days after Franklin Templeton Asset Management Company announced closure of six of its debt fund schemes, the Reserve Bank of India had announced a special liquidity facility of Rs 50,000 crore for the mutual fund industry to avert spread of contagion. The governor acknowledged the critical role of NBFCs, including micro finance institutions, in delivering last mile credit, and the importance of mutual funds in financial intermediation, RBI said in the statement.

History of this topic

RBI deputy governor urges banks to be prudent on lending to NBFCs

Live MintMSME margins badly hit by commodity price surge: PHDCCI

The Hindu

RBI Governor Shaktikanta Das pitches for higher investment in infrastructure, health post pandemic

India TV News

Kerala CM seeks banks’ cooperation to tackle Covid financial crisis

Live Mint)

Economic Activity Recovering Since Late-May, Rising Cyber Attacks a Risk: RBI Guv

News 18)

SIDBI Unveils New Term Loan Scheme for MSMEs Hit by Covid-19. Details Here

News 18

Diminishing options: The Hindu Editorial on RBI’s June 2021 policy statement

The Hindu

RBI may have to delay liquidity normalisation amid rising virus cases

Live MintPolicy roll-back may dent banks’ health, says RBI

The Hindu)

RBI Governor Shaktikanta Das Discusses Credit Flow, Rate Cut Transmission With Bank MDs

News 18

Will take necessary measures to promote growth: RBI Governor

India TV News

PMC Bank: RBI cites liquidity issues for not raising withdrawal limit beyond ₹1 lakh

Live Mint

Rs 10,000 crore Fund of Funds for MSMEs to be operational soon: SBI Chairman

India TV NewsIndia needs ₹ 50-60 lakh crore foreign investments to bolster coronavirus-hit economy: Gadkari

The Hindu

NBFCs will continue to face liquidity, asset quality risks: Fitch

Live Mint

RBI Governor Shaktikanta Das briefs central board about impact of monetary steps

India TV NewsThe problem with the liquidity push

The Hindu

It’s only a pause, more steps to come to deal with covid-19 crisis: Anurag Thakur

Live Mint)

Economic package: Successful implementation of support measures for NBFI will be key, says Fitch Ratings

Firstpost)

Coronavirus impact: NBFCs urge RBI to allow draw-down from reserves for provisioning

Firstpost)

Bankers welcome economic package announced by govt, say will encourage lending to MSMEs

Firstpost

Liquidity lifeline: The Hindu Editorial on Nirmala Sitharaman’s MSME package

The Hindu

FM Nirmala Sitharaman announces collateral free automatic loans for MSMEs

India TV News)

Coronavirus Outbreak Updates: 20-day-old infant among six deaths reported in Rajasthan today; COVID-19 cases rise to 2,772 with 106 new infections

Firstpost)

RBI's liquidity support for MFs may struggle to be effective; Fitch says success will depend on banks' appetite to take up risks

Firstpost

RBI's liquidity support for MFs may struggle to be effective: Fitch

India TV NewsRBI opens ₹50,000 liquidity tap for Mutual Funds

The Hindu)

RBI MF liquidity window to improve investor confidence, calm down corporate debt market: Experts

Firstpost)

Coronavirus Outbreak: SIDBI to provide 90-day term loans to banks, NBFCs, MFIs for onward lending to MSMEs

Firstpost

RBI measures for NBFCs may not boost credit flow to the broader economy: Moody's

India TV NewsCoronavirus | Salaried borrowers continue EMIs, ignore moratorium offer

The HinduRBI ensures liquidity support to NBFCs

The Hindu)

RBI Governor Press Conference: Shaktikanta Das announces relief measures for liquidity in system, to ease financial stress

Firstpost

RBI cuts reverse repo rate, announces steps to boost liquidity | Highlights

India TV NewsMoratorium on repayment puts NBFCs in a spot

The HinduCOVID-19 impact: Moody’s changes outlook on Indian banks to negative

The Hindu)

RBI announces repo rate cut, liquidity easing measures; economy requires stimuli, say analysts welcoming move

Firstpost

Opinion | What the RBI’s statement did not say

Live Mint

Coronavirus lockdown: RBI cuts repo rate, announces 3-month moratorium on loans, read details

Op India

EMIs put on hold, interest rate cut: RBI injects virus-fighting stimulus to tackle Covid-19 crisis

India TodayReady for COVID-19 impact: RBI Governor

The HinduWill add liquidity if needed, RBI assures Yes Bank depositors

The Hindu

RBI Press Conference | Highlights

India TV News

RBI asks NBFCs to adopt better tools to detect liquidity strains early

Live Mint

RBI not looking at liquidity facility for NBFCs: Dy Guv Vishwanathan

Live Mint

Liquidity taps opened for banks and NBFCs

Live Mint)

RBI governor Shaktikanta Das rules out asset quality review of NBFCs for now

Firstpost

MSMEs seek urgent relief package from Nirmala Sitharaman

Deccan Chronicle

Central bank opens liquidity tap to help stressed shadow banks

Live MintDiscover Related

)

)